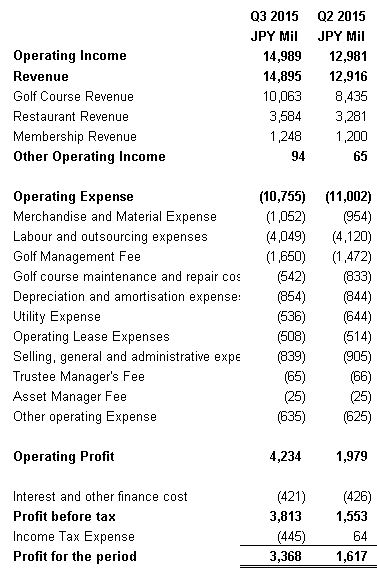

I haven’t been blogging often as I am quite lazy by nature and not a very good writer. I would like to provide an update to the Q3 result of Accordia Golf Trust which I am vested in. As we can see in their QvQ result, nothing much has changed except for Golf Course Revenue which has increased significantly due to better weather. Restaurant revenue is pretty consistent QvQ and membership revenue are collect in Q4 and recognised monthly hence there should not be huge fluctuation. One of the strong point about AGT is the ability to manage cost well. You do not see huge swing in their operating expense unlike some other companies which is something I greatly appreciate.

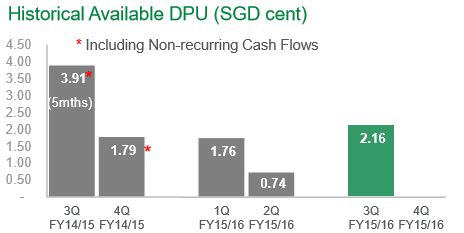

The biggest change this quarter is Golf Course Revenue due to seasonality. After the previous announcement in Q2, the share price plunged from 64 cents to a low of 48 cents as the DPU was a a paltry 0.74 cents. Q3 DPU is 2.16 cents which brings YTD DPU to 4.66 cents. At 48 cents, this is a 9 months 9.7% yield!!!

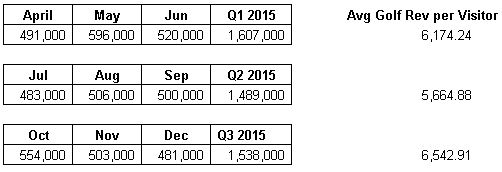

If you were to look at the above table I computed, what happened was the total number of visitors went up and average golf revenue per visitors increased about 15%. This is significant as I mentioned in my previous blog post that it takes approximately 1.15 millions visitors to breakeven. An increase of 15% in average golf revenue per visitor means that it takes lesser visitors to breakeven. All incremental visitors revenue are taken straight to the bottom line as operating costs are quite consistent. My guess is play fee was lower in Q2 to encourage more visitors during bad weather hence that is good stewardship of the company by the management.

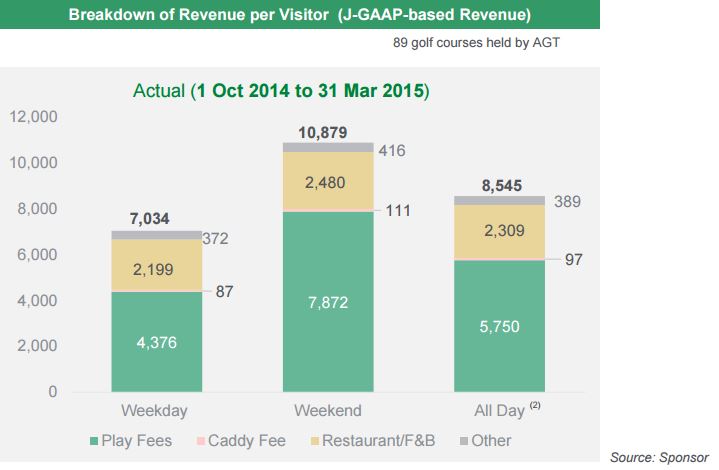

This slide by the sponsor further shows the difficulty in trying to forecast revenue as the play fee between weekday and weekend is quite huge hence visitors number by itself does not provide a complete picture of the result we can expect quarterly.

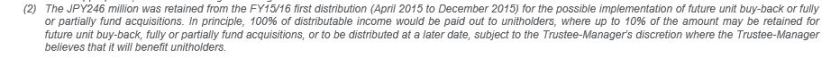

Refund of distribution income witheld

I did not like the decision to withold 10% of earning in Q2 during a bad quarter and there was no acquisition or unit buyback. This really creates a lot of uncertainty which is something unitholders and market dislike. Do note that management will be paying out the 10% withheld in the coming 2H distribution.

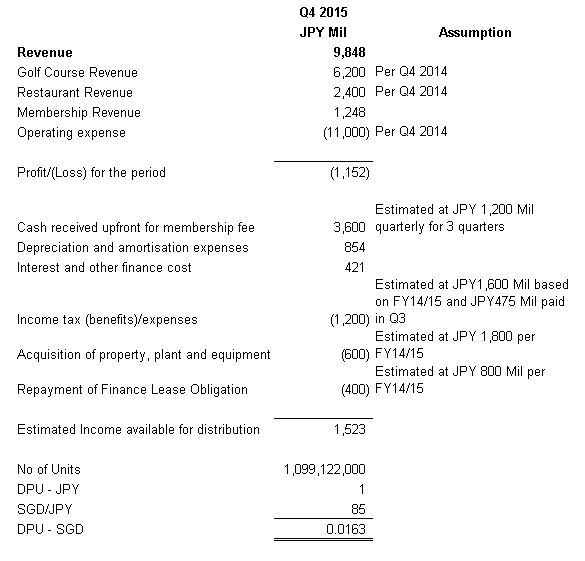

Forecast for Q4 15/16

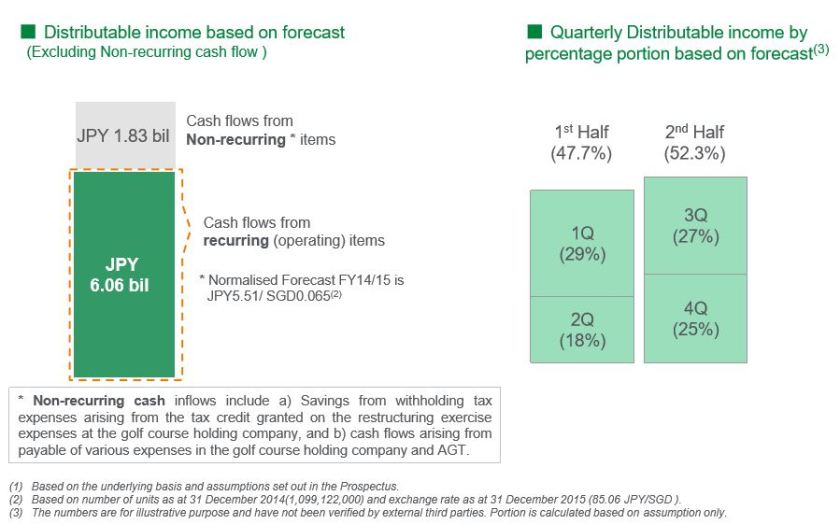

The normalised DPU for FY2015 is 6.5 cents and YTD 2016 is 4.66 cents which means we require 1.84 cents to reach 6.5 cents. If we were to use the quarterly distribution forecast disclosed, Q4 should see a similar payout to Q3. However, membership revenue for whole year should be only JPY4.8bil (JPY1.2 bil quarterly per financial statements)

I did a computation using some estimates from Q4 14/15 and we should be able to see 1.63 cents for Q4 FY15/16 bringing whole year DPU to S$6.29 cents. This is still below the normalised FY14/15 of S$6.5 cents. I have to emphasis there are some uncertainty here being revenue (impossible to forecast!), income tax (not sure if there are any 1 off affecting prior year figure and how much) and other capex needs. The upside is the foreign exchange rate. Now SGD /JPY is approximately 80 so this may surprise on the upside as we are using JPY 85. If I were being prudent, I will only assume 5.5 cents for the FY to look at this investment (payout ratio of 90% and downside risk for JPY in the long run).

Conclusion

On the whole my investment in Accordia was a learning experience and I made a few mistake.

Anchoring Bias – My entry price was based on how much the share price has fallen from IPO and the discount to NAV.

Lack of long term track record of the company – As this is a newly IPO company, they lack the long term track record required to even out the seasonality and to be able to judge the track record of the management. What is a value buy can turn out to be a value due to management destroying shareholder value. I am sure seasoned investors have their fair share of experience with such companies.

Understanding of the business – I had no idea that weather play such a huge role in the nature of this business and the revenue swing it brings. While I understand that the golf industry in Japan is declining (the population declined 1 mil in a recent news article!), I am of the belief that there is also money to be made in sunset industry. Especially since the industry is fragmented so there will be consolidation opportunities. In sunset industry, you are more likely to find mispriced asset rather than growth industry, where the entry price is so high that it does not afford us a margin of safety in our investment. This seasonality issue would have been resolved if the company has a long track record as we can average it out over the long run.

Going forward, I will continue to make more newbie mistake but I hope none will be costly. Thank you and have a great weekend.

IIHAMD,

If u want track records u can look at the parents results. It is also rather stable with its golf driving ranges providing the “growth” which is absent from AGT. Hopefully the future acquisition will include some “golf driving range”, and I can rest my case that management is not dumping. Parent company do not hold a big stake and it made me suspicious of their intent

LikeLike

Hi Sillyinvestor, I did take a look at the parent’s results over the year and it seems stable. Actually I think golf is a lifestyle item and very popular among Japanese Corporate so the demand will still be there. Weather has a bigger part to play. Agree with you that there is alway worry of dumping hence only time will tell. The catalyst for this trust is the acquisition and the targeted 60% gearing level. Assuming future acquisition will be coming from pure debt perspective. This trust can be yielding double digit on cost. My main worry is the Japanese population shrinking more than the yen.

LikeLike