Many times we have heard investors describe themselves as a value investors but how many of them are actual value investor? Value investor has to be one of the most over used and abused description used by retail investor to describe oneself. According to Investopedia, value investing is an investment strategy where stocks are selected that trade for less than their intrinsic values. The concept is basically buying a stock you believe to be undervalued and applying a margin of safety to what you believe is the intrinsic value. This ensure that in the event of a mistake, your capital is protected. The key focus is protection of capital and not swinging for the home run for every pitch. Why is being a value investor hard?

Difficulty in measuring intrinsic value

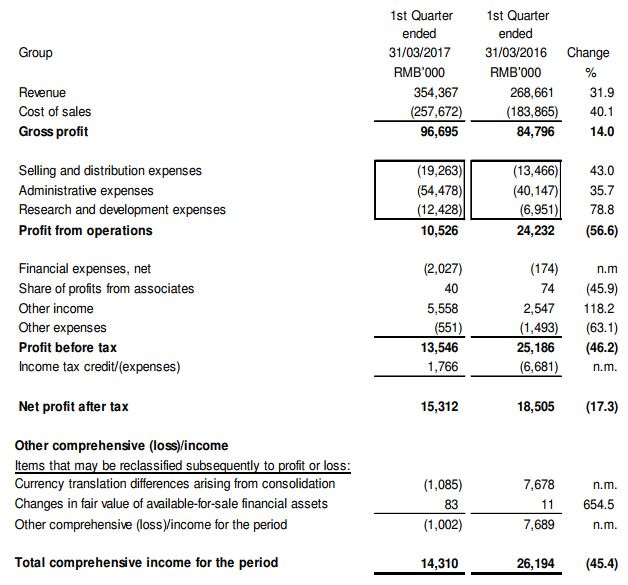

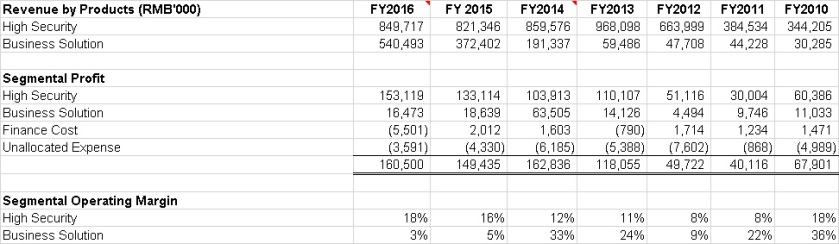

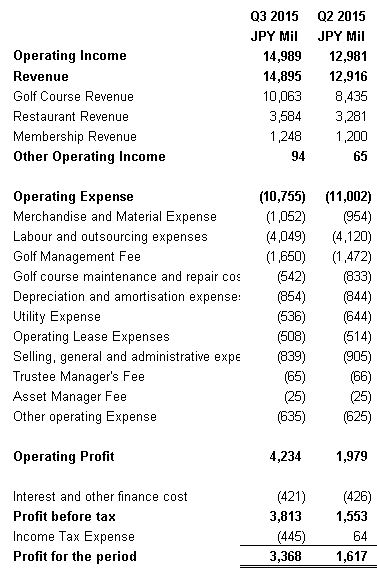

Measuring the value of a company can be a very tricky business. One has to understand accounting before even attempting to pick stocks because you need to understand the benefits of accounting and the limitation it brings. Accounting is not the most exciting subject to be taught in school and hence most people do not maintain the interest to study the subject in detail. Being an accountant by training myself, I admit that there are also companies which are beyond me as I do not understand. For example FRS 41 which is the standard used for Agriculture. I have totally no idea of the subject.

Measuring the value of an asset is also a very complicated task due to the different measurement method you can adopt. Below are the few methods used:

Historical Cost – This is the cost which the asset was bought at. For example the HDB flat bought 30 years ago for S$70k which costs S$300k today. Historical cost is the most reliable as supporting documents can be produced to verify the accuracy of the value.

Fair value – This is the value derived between both willing and knowledgeable buyer and seller. For example when there is M&A the assets and liabilities of the company are fair valued and any short fall/excess of the buying price above the fair value of the company will be recorded as goodwill or bargain on purchase. The problem with such an approach is the assumption both parties are knowledgeable.

Value in use – This is the value of putting the asset into use. For example, the house you are living in. If you do not own the house you got to pay rent on it. Hence the idea is to purchase the asset and put it into use and generate profit. Profit can be derive from increasing revenue or decreasing expense. That’s why the tendency to automate to reduce labour cost and increase revenue through efficiency. Most of the Property, plant and equipment of the company falls into this category. However, if the PPE was internally constructed or created, it may allows for financing cost to be capitalised resulting in a higher asset value. An example will be Company A and B building the same plant but due to higher construction cost and financing cost, Company A may end up with a higher value asset than Company B but seriously this is due to higher cost and not due to different in specification. Overpaying suddenly looks good.

Replacement cost – Replacement cost simply refer to the cost company has to incur to replace the same asset.

Net Present Value – This is basically discounting the future cashflow to today’s value. Example of it are annuities and stock. The price of the stock is basically the future cashflow and residual value of it. The discount rate used and assumption matters on the value you derived at.

Based on the more common and easier methods I describe above, they are all correct and can be used to measure an asset. However they all derived different value hence intrinsic value is tough to gauge. Let me use a HDB flat as an example as it is easy to understand. The flat was bought 30 years ago at S$70k (historical cost). Today similar flat is sold on resale market at S$300k (fair value). Because I stay in it, I save S$2k a month (value in use). If I rent it out at S$2.2k a month and with 2% rent escalation a year to account for inflation (NPV), I get a different value. The cost to build a similar flat today (maybe S$200k) will be higher than 30 years ago due to construction cost increase and land cost and inflation etc (Replacement Cost). The typical issue in measurement/accounting is reliability vs relevance. Hence without the proper training, it is very tough to determine intrinsic value in practice.

Temperament

The return of an investor is also largely determine by his personality. This is not something that can be taught unless some life altering event happen to him. Our good friend above has the following advice for people but while the concept is simple, it is not easily followed. There is no comfort in being a contrarian in a bear market. You do not contra just to be different. You have to be contrarian because your analysis tells you so and not because people/market tells you. You can observe in young kids when they are feeling fearful or uncomfortable they will seek the assurance of their parents. It is the same for investor seeking assurance by selling their holdings because everyone is doing it when they should be buying. How many times have you read in forum people advising for the dust to settle before buying or you will end up catching a falling knife. If you wait for the dust to settle you might end up missing the boat. Profit are made when market is confused, not when it is certain. You might have the best laid out plan for a crisis but it might not be executed properly due to your emotions. This require the investor to keep a cool head and always apply second or third degree thinking. For example, everyone knows IDA is looking to introduce a fourth telco. Hence everyone say due to increased competition, it is better to sell as margin will be affected. The level headed investor will seek to determine how much of the revenue will be affected, any mitigating factors (new revenue stream such as cyber security? look at myrepublic internet take up rate? associate growing? Lower future capex spending due to technology improvement?) and if the market oversold, value might appear. You buy not because of reverting to the mean because if the market has changed, the mean might not revert. You buy because your analysis say so.

The value investor also require a lot of patience to sit on his butt and do nothing if there is nothing to buy. Sitting down and doing nothing while observing the market is one of the toughest thing to master. If you read a few investment books, you will notice they mentioned that the biggest loss and gain are normally made over a few days in a year or few. Hence it is very hard to time the market to buy or sell. The value investor needs patience to wait for opportunity to appear to get in with margin of safety and to sell when his analysis is wrong or valuation is bubbly.

Reading widely and thinking deep

The value investor also needs to read widely and think about changes happening and how it will affect his business. The changes/competition might not be coming from the industry but from another industry. You need to be aware of such changes. I observed that there is a certain state of mind which one needs to require to be ideal for investing but it is kind of oxymoron. An individual needs to keep an open mind in order to absorb new ideas into his thinking but staying firm on decision based on this investing analysis. This is very very hard to achieve as if the company you have bought is facing headwind, everyone will be telling you to reconsider or to pare down the position. However your analysis tell you this is temporary set back before it will continue to scale new height. Families and friends will be thinking you are a stubborn old mule but in your mind you are sticking to your decision because your analysis tell you this is temporary and over reaction by the market. This will be very trying times for the value investor and hence how he reacts to such situation will determine his return.

Conclusion

The value investor requires a wide set of technical skills and correct temperament in order to be successful. Not many investor fulfills the criteria and the next time you hear someone describe themselves as a value investor, observe them for a period of time and you will know which one is the charlatan. I could go on and on but you get the idea. Thanks for reading.